The con man of Galt’s Gulch Chile, Ken Johnson, was to appear in Chilean court on December 12 2016 for a hearing on the felony cases against him  for defrauding 73 families of $10.45 million dollars. Johnson, however, as was no surprise to us GGC victims, didn’t show up in court. His lawyer claimed that he was called away to the USA due to his parents failing health. The ambulance chaser showed as evidence Johnson’s boarding pass for a flight to Mendoza, Argentina. Reportedly, everyone in the court room knew his excuse was a lie, since Mendoza has no flights to the USA. Despite the obvious contempt Johnson showed the Chilean court, the judge continued the hearing until January.

for defrauding 73 families of $10.45 million dollars. Johnson, however, as was no surprise to us GGC victims, didn’t show up in court. His lawyer claimed that he was called away to the USA due to his parents failing health. The ambulance chaser showed as evidence Johnson’s boarding pass for a flight to Mendoza, Argentina. Reportedly, everyone in the court room knew his excuse was a lie, since Mendoza has no flights to the USA. Despite the obvious contempt Johnson showed the Chilean court, the judge continued the hearing until January.

Here’s a link to the Curacaví El Mauco article about the hearing.

Ken Johnson’s Fraud Case to Be Made Official Imminently

Ken Johnson is currently a delincuente prófugo, unofficially as of yet, but the official status is coming. Wherever his is, we’re sure he hasn’t found a new scam and is getting bored, because he’s been posting on a libertarian forum again, attacking Jeff Berwick and lying about GGC.

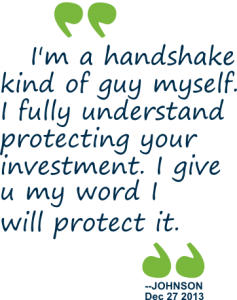

His latest Facebook post, when  deconstructed (below), is somewhat informative, at least to demonstrate his perfidy. As always, Johnson takes a tiny bit of truth, wraps it in compounding lies and spews it out everywhere he can, like the psychopath he is. His tactics are always the same: accuse everyone else of his very crimes and sit back to watch them scramble to defend themselves.

deconstructed (below), is somewhat informative, at least to demonstrate his perfidy. As always, Johnson takes a tiny bit of truth, wraps it in compounding lies and spews it out everywhere he can, like the psychopath he is. His tactics are always the same: accuse everyone else of his very crimes and sit back to watch them scramble to defend themselves.

The trouble for Johnson is, we aren’t scrambling. Besides the fact that he’s so transparent, no one is listening to this grifter, anyway. He’s like a stray dog howling to the moon. The people with the power to put him behind bars pay no attention to his howling.

Johnson’s Facebook Post Deconstructed

Li’l Kenny Fraudster wrote: On December 12, 2016, Galt’s Gulch Chile was violently raided by 20 armed men, lead by Mario Del Real, a Chilean real estate swindler and associate of convicted felon EJ Lashlee, Josh Kirley, Thomas Baker, and Catharine Cuthbert. Del Real, and his cohorts, shot at and physically attacked the workers of GGC.

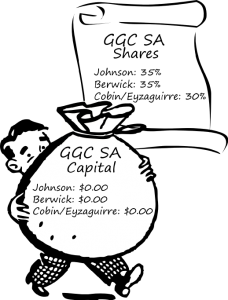

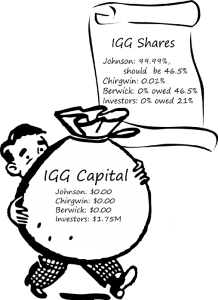

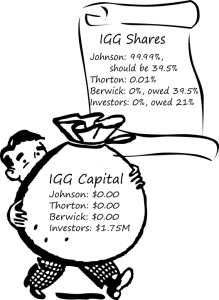

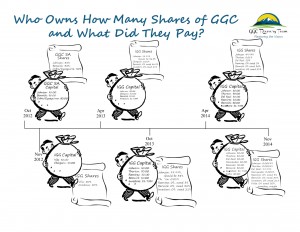

FACT: None of the innocent people libeled in this mendacious sentence have any relations with Mario Del Real. Del Real is Ken Johnson’s partner in crime, and conned Johnson out of his stock in the real estate holding company for Galt’s Gulch Chile, Inmobiliaria Galt’s Gulch, proving the ancient adage there is no honor among thieves. From August 2014 till January 2015, Mario Del Real tried to extort the GGC investors no fewer than five times. We repeat, we have no relations with Mario Del Real. Grifter Ken Johnson does.

LKF: After tying up some of the workers, Del Real then threw all of them into the street and ransacked their homes (our workers have lived on GGC land for many years), along with the buildings, farm, and land, of GGC. Some of these crimes were caught on video by witnesses, and have recently been presented as evidence of these crimes. The local prosecutor has recently been removed from involvement with these crimes and we hope to make sincere progress with the formalization and convictions of those mentioned above for a long list of crimes against GGC and our honest clients.

FACT: The local prosecutor, Cristian Cáceres, has not been removed from the fraud and other felony cases against Ken Johnson and Mario Del Real. He has been joined in that position by a prosecutor from the complex crimes prosecutor’s department– analogous to white collar crime–for the country of Chile. In other words, the government of Chile has added to its investigation and prosecution of the Galt’s Gulch Chile scam perpetrated by Ken Johnson and Marion Del Real.

LKF: This violent entry and attack of December 2016 was nearly identical to a violent entry and attack carried out on GGC property in October 2014, by Del Real, Kirley, Baker, Lashlee and Cuthbert. Shortly after their violent attack in October 2014, they retained hostile possession of GGC’s farm, buildings and land.

FACT: This is an abject lie. The people named committed no violent act of any kind. The truth is that Johnson, realizing the jig was up on his fraud, fled the farm to avoid the investors out of fear. Johnson voluntarily abandoned Galt’s Gulch Chile and the farming operations in November 2014.

However, in April 2015, Johnson hired four armed thugs to terrorize the investors’ employees at gun point and remove them from the property. This raid by Del Real is therefore reminiscent of Johnson’s violent raid of the farm 20 months earlier.

LKF: While holding hostile possession of GGC’s land, Kirley and Del Real entered into a private arbitration process with one another in March 2015 in order to obtain a favorable financial ruling for Kirley, so that Kirley and Del Real could then attempt to force the sale of GGC’s land assets to pay Kirley’s and Del Real’s arbitration ruling, and to attempt to purchase GGC’s assets at auction.

FACT: All arbitrations are private. There is nothing nefarious about that. Josh Kirley’s contract with GGC stipulates that disputes are to be resolved via the arbitration center at the Santiago Chamber of Commerce. The arbitration was completely lawful.

FACT: Kirley has no relations with Del Real and has met him only once through Ken Johnson at the GGC farm.

FACT: Josh Kirley’s arbitration was to recoup his “investment” in GGC since the project is a fraud. The only assets that GGC holds are the two parcels near Curacaví. To pay Kirley’s refund, the parcels will be auctioned, as is required by law. Again, there is nothing nefarious about this. To the contrary, this is how the system is supposed to work. Johnson is 100% at fault in this situation since he broke his contract with Kirley.

LKF: These hostile actions in October 2014 occurred three weeks after GGC obtained subdivision approvals and shortly before GGC was to complete payments on its land and water assets.

FACT: Johnson never obtained the full subdivision approval for the GGC project. He received a preliminary approval for the subdivision of the orchards as orchards, ie, the purpose of the land had not changed. Further approvals are required by the Metropolitan Region of Santiago for which Johnson has never applied.

Yeah, About Those Contracts…

LKF: 80% of GGC’s contracts with clients would have been completed in late 2014 had these parties not sabotaged the project in a violent and seemingly criminal manner.

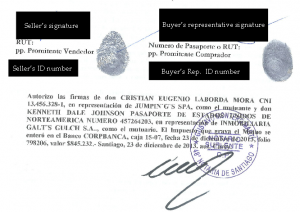

FACT: This is a completely misleading statement. Johnson is referring to the contracts signed by investors who bought shares of a farming operation, Agricola Galt’s Gulch. Nearly everyone who bought into Agricola signed three contracts, making the number of contracts mentioned here appear to represent the interests of the vast majority of investors. In fact, only 16 of the 73 investors held contracts with Agricola, totaling just under $1 million, or less than 10% of the funds investors poured into the GGC fraud.

Five other investors signed contracts to buy 25 acre orchards, but their contracts included residential lots, for which there are no approvals, and loans to GGC. The same is true for several of the Agricola investors, that they hold contracts for residential lots and/or loans. Combining the two groups of investors, fewer than 30% of GGC investors could have had maybe one of their multiple contracts satisfied, if the subdivision approval that Johnson obtained for GGC were completed. Again, the approval was not completed.

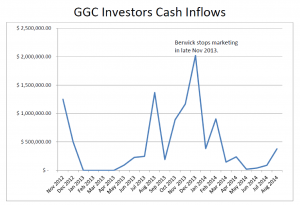

There was simply no way Johnson could ever make good on any of the contracts outstanding. The project was stalled due to Johnson being defrauded by Mario Del Real, Johnson’s mismanagement, his embezzlement and his inability to find more suckers. See our post, “Why Did GGC Fail So Spectacularly, So Fast” for the details. The GGC fraud collapsed by June 2014, while the investors took over the property in November 2014.

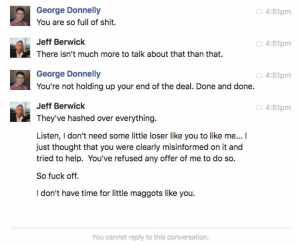

LKF: Kirley, Baker, Cuthbert, Lashlee and anarchist conman, Jeff Berwick, have been in collusion with Mario Del Real since early 2014, and possibly late 2013.

FACT: Kirley, Baker and Lashlee met Mario Del Real in mid or late 2014 and each met him only once. Cuthbert has never met Mario Del Real. None of the people mentioned have any relationship or dealings with Mario Del Real of any kind. This is utter fiction. Jeff Berwick has never met Del Real, and didn’t even know who he was or what is role in the GGC fraud was until some time in 2016.

On the other hand, Johnson brought Del Real into GGC affairs and is currently colluding with him to thwart investors efforts at restitution.

LKF: They have zero care about the ideas and beliefs about organic farming, peaceful living and other positive aspects of GGC.

FACT: How would Johnson know any of this about us? He doesn’t know us.

Peaceful living? Positive aspects of GGC? Being an affinity fraud, there are no positive aspects of GGC.

There is no organic farming. Certifications were never completed and the promised farming project was always a total fiction.

More importantly, no one would ever refer to Johnson as peaceful. He has physically attacked his co-workers and employees on several occasions. He also repeatedly held his Chilean employees at gun point while interrogating them and while filming videos. We hardly consider that peaceful.

LKF: We intend to win in the courts against these highly unethical and dishonest people and we intend to complete GGC for our honest clients, without this corrupt group that has aided Mario Del Real and Pamela Del Real with a long list of crimes, dating back longer than three years now.

Good luck with that, Li’l Kenny Fraudster. You can’t win in court when the documentary evidence and eye witness testimony is piled sky high against you.

Btw, Johnson also posted his typical, crazy mendacious screeds at Liberty.me. He told a new lie there, that he has never turned anyone into government agencies. He was trying to make himself appear to have libertarian principles to gain sympathy on that forum.

The facts are just the opposite. Johnson has:

- harassed former employees multiple times by submitting complaints to the police and the PDI (Chilean equivalent to the FBI.)

- reported Berwick and one of his friends to the Canadian authorities.

- repeatedly reported John Cobin to the Chilean authorities and even sued Cobin and Cristian Jorquera, the owner of the local newspaper, for libel. He also paid two law firms to explore suing Cobin for breach of a non-compete agreement. Paying lawyers to pursue Cobin wasted nearly $100,000 of investor money.

- reported Mario Del Real to the PDI and has two felony cases against him in the Chilean courts.

We have the documentary evidence for all his actions above, including some of Johnson’s own videos. !?!

One Last Note on the Criminal Cases

The January hearing to make the felony cases against Johnson official was again postponed to give the new prosecutor assigned to the GGC fraud case time to prepare his team. We will announce the new hearing date when this information is available.

For the pdf version,

For the pdf version,