“It’s my dream to not have contracts in Galt’s Gulch, and to share a common bond of truth and integrity… and vision.”

–Ken Johnson

There were five types of contracts Kenneth Dale Johnson used to accept funds for GGC:

- Heads of Agreement (HOA) (click here) for equity positions and residential lots to the first four investors referred to as “The Founder.”

- Promise to Purchase a residential lot coupled with a loan for investors called “The Second Round Founders.” (Click here.)

- Promise to Purchase a pre-sale lot (click here). The term “pre-sale” was used to imply special pricing because subdivision approvals had not yet been obtained.

- Farm Share Subscriptions, the sale of shares of Agricola y Comerical GG SpA and loans to Agricola for land purchase and improvements (click here). Some also include options on residential lots. Fifty hectares were to be transferred from Inmobiliaria to Agricola after subdivision of the orchards. These investors would own this 50 hectare farm through owning the shares and would be paid the profits of the farm through dividends.

- Promise to Purchase an Orchard (click here). These are five 10 hectare lots planted in lemon trees that were also to be subdivided from the agricultural zone.

The Heads of Agreement was new to us. According to Wikipedia, “A heads of agreement is a non-binding document outlining the main issues relevant to a tentative (partnership or other) agreement. A heads of agreement document will only be enforceable when it is adopted into a parent contract and subsequently agreed upon. Until that point, a heads of agreement will not be legally binding (See Fletcher Challenge Energy v Electricity Corporation of New Zealand [2002]2 NZLR 433).” This type of document may have been used because the corporate structure was not complete. The HOAs were supposed to be followed by a “comprehensive partnership deed.” This never materialized.

The “promise to purchase,” in Spanish “promesa,” is a preparatory contract by which two or more parties agree to enter into a future contract on a specified date and/or subject to the occurrence of an event. In this case, the future event that conditioned the execution of the promised contracts—a sales contract for a lot—was the subdivision approval of the land, the farm named Lepe/Las Casas.

Within these types of contracts, there are various versions. We stopped counting at 15. Our speculation about why there were so many versions of the contracts is that with time and feedback, Johnson was learning that his contracts were problematic, causing him to continually fiddle with the provisions.

One change is that later promesas had a provision saying the contracts are conditioned on “the smaller 10 hectare parcels legally exist[ing], through the approval of the subdivision…” (We wonder if this is an error. Johnson may have meant to say lots smaller than 10 hectares.) Early promesas don’t stipulate the size of lots that must be approved. The change may have been due to the difficulties Johnson was having in obtaining subdivision approval.

There are problems with most of the contracts, either in the provisions, or with how they were executed, or more precisely, not executed. Out of 73 investors, maybe 62 have these problems. The GGC Recovery Team attorney in Chile said that the vast majority of the ones he has seen are flawed.

Jurisdiction—Just Try to Get Your Money Back

Possibly the most significant problem is the jurisdiction issue with all contracts signed before October 2013. The HOAs claim the jurisdiction of London, UK. The remaining contracts claim the jurisdiction of New Zealand.

The HOA investors bound by London jurisdiction paid their funds to the Bank of New Zealand account of attorney Greg Stewart, who forwarded those funds to Banco Itaú in Chile. There are no assets in London. The claimed connection to London is unclear.

The HOA investors bound by London jurisdiction paid their funds to the Bank of New Zealand account of attorney Greg Stewart, who forwarded those funds to Banco Itaú in Chile. There are no assets in London. The claimed connection to London is unclear.

Most of the other investors bound by New Zealand jurisdiction paid their funds to Banco Itaú in Santiago. There are no assets in New Zealand, nor were there any during the time that the majority of these contracts were written, although it appears that two residential lot option buyers sent their funds to New Zealand, similar to the equity investors.

The ostensible reason for the New Zealand connection—a corporate structure of a limited partnership that would act as trustee of a trust that would own the Chilean entities—was tax efficiency. However, the documents for this structure were not completed. The New Zealand lawyer who began the process of structuring these entities repeatedly wrote to Johnson to warn him that double taxation may apply because the documentation was not complete.

structure of a limited partnership that would act as trustee of a trust that would own the Chilean entities—was tax efficiency. However, the documents for this structure were not completed. The New Zealand lawyer who began the process of structuring these entities repeatedly wrote to Johnson to warn him that double taxation may apply because the documentation was not complete.

If tax efficiency weren’t that important to Johnson, could the confusion of multiple jurisdictions have been his aim? Say one of the equity investors sues and receives some kind of judgment against GGC in London, there are no assets in London to attach. Or should he go after the Bank of New Zealand account for satisfaction? But it’s owned by someone else and has no GGC funds. If he tries to sue in Chile, the judgment could be enforced provided that exequatur requirements found in both international legislation (New York Convention on the Enforcement of Arbitral Awards) and local rules are met, and provided that the defendant entity is the same entity that took part in the foreign arbitral proceedings. In some of the cases, this is legally impossible; in others, the costs involved in the different stages of the process are prohibitive.

On June 16 2014, Johnson wrote to an investor regarding refund requests:

“The contracts are private offshore agreements, so there is no tie to Inmobiliaria GGSA on most of them. It says they can ask for a refund after map approvals if they don’t find a lot they like.”

This quotation shows that Johnson purposely structured the contracts to severely limit the potential for refunds or lawsuits.

Are these contracts legal? Our attorney has informed us that despite the declared jurisdiction, since the GGC real estate is located in Chile, the promesas on lots must follow Chilean law. With only two exceptions, none of the promesas do.

Requirements for Valid Contracts in Chile

To be valid in Chile, the contracts can be in any language. Those that ultimately convey property titles under the urbanism law, such as the residential lots, require the signatures to be notarized. If the signatures are notarized outside of Chile, further legalization by a Chilean consulate is required. (Chile is not a signatory to the Apostille treaty.) Only the original documents can pass through this process, not electronic scans. The documents must be filed in the register of public records of a Chilean Notary.

Further, because GGC was selling lots before subdivision approval, a bond or insurance was required to protect the buyers. Johnson did not post bond, nor did he buy insurance.

The Agricola Share purchase agreements need not be notarized, but any associated residential lot promesas are different matter. They must follow the same rules as the other residential promesas.

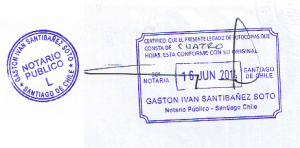

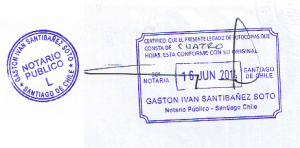

There are many contracts that bear a notary stamp dated on the  same day— June 16 2014— and as “a true copy,” even though these contracts were signed during the eleven and a half month period, from June 16 2013 to May 30 2014. This stamp does not make real estate promesas legal in Chile.

same day— June 16 2014— and as “a true copy,” even though these contracts were signed during the eleven and a half month period, from June 16 2013 to May 30 2014. This stamp does not make real estate promesas legal in Chile.

You might wonder why this notarization happened. Why would contracts signed on all different dates, from June 16 2013 to May 30 2014, be brought to a notary on the same day, June 16 2014, copied and stamped when this is a meaningless exercise in terms of the legal requirement?

We speculate that Johnson finally realized that virtually none of the contracts were properly executed. Indeed, in a conversation he had with one of the investors, Johnson admitted that all the contracts that weren’t notarized were invalid.

“I have copies of all of them [the contracts] that I got notarized, you know legalized, just so there’s some merit to them, you know, for the people who haven’t, who haven’t met me at a notary or sent a power of attorney and that kind of stuff, right?” [Emphasis added.]

Despite what Johnson said, it’s doubtful that the purposed of this exercise was to help the hapless investors who didn’t have legal contracts. We speculate that as a CYA maneuver, he gathered the contracts—including some share subscription agreements that didn’t need to be notarized—went to his friendly, neighborhood, crooked notary and asked what to do. The guy said he’d stamp them as true copies. Stupid gringos will think it looks official, and they don’t read Spanish anyway, so they’ll be none the wiser. If that’s what he said, then he was correct.

This is the crooked notary’s stamp. The round stamp was put towards the bottom of each page and the rectangular one was put on the last page. It says, “I certify that this resulting photocopy consisting of four pages conforms to the original.”

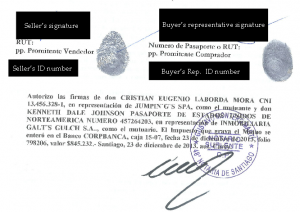

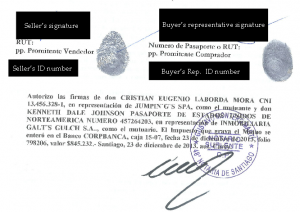

This is a legitimate notary stamp, placed on two sheets across the staple to prevent the pages from being separated and possibly substituted. Below is the stamp this notary used for the signatures.

Note the ID numbers and finger prints. In this case, a lawyer with a power of attorney signed for the buyer.

Ponzi Contracts

Perusing the “Second Round Founders” contracts, you’ll find unusual features. The investment is a non-interest bearing loan that is to be paid back 100% in three years, with title to a residential lot also to be transferred to the investor by the end of year three. Zero interest loans can be found when a developer is trying to push sales, but usually the situation is the other way around, that is, the developer offers zero percent financing to the buyer. It may be possible that the residential lot represents interest paid on the loan to the investor, although the contract does not say that.

Be that as it may, this is an aggressive loan schedule, especially  considering that Johnson committed to delivering developed lots, yet did not have subdivision approval, had no real estate development experience and knew virtually nothing about Chile, not even the language.

considering that Johnson committed to delivering developed lots, yet did not have subdivision approval, had no real estate development experience and knew virtually nothing about Chile, not even the language.

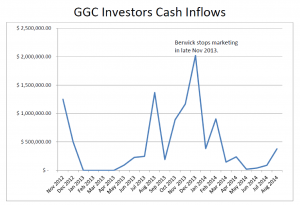

The second founders round loans, including the orchards, totaled $4.6 million and were ostensibly for subdivision approvals and infrastructure, yet those funds were used to make the payments on the prodigiously priced land that Johnson represented GGC already owned free and clear. How was he to begin repaying the loans, as required by the end of year one, other than by bringing in new investors?

Another little twist to the second founders round “investment” is that even though the contract says that the loan is being made to a New Zealand entity, the payment was made to the Asesorias y Servicios Galt’s Gulch SA bank account in Chile.

As an interesting aside, Johnson insists that the second founders round investors are neither investors nor creditors. He refers to them as “clients.” We can think of a couple of reasons why. If they are investors, the SEC would probably love to be sniffing around for a prospectus, of which there is none. Or maybe Johnson wants to make very sure that these “clients” don’t get the uppity idea that they have any claim on GGC’s entities.

Shares of a Whole Lot of Nothin’

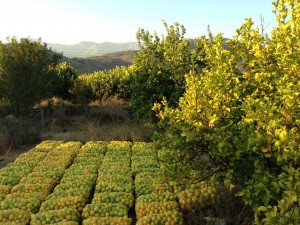

Johnson incorporated a company for the farm operation. The shares of Agricola y Comercial SpA were supposed to represent an ownership stake in an organic farm operation, both a piece of the action on  existing lemon and avocado orchards and the profits from a long list other fruit and row crops. The real estate holding company, Inmobiliaria Galt’s Gulch SA, has an area of 100 hectares much of which is a lemon orchard. Johnson planned to subdivide this area into five 10 hectareorchard lots and one 50 hectare lot. The five smaller lots would be sold to individual investors to be managed by GGC. The 50 hectare lot would be sold to Agricola and be owned by the shareholders.

existing lemon and avocado orchards and the profits from a long list other fruit and row crops. The real estate holding company, Inmobiliaria Galt’s Gulch SA, has an area of 100 hectares much of which is a lemon orchard. Johnson planned to subdivide this area into five 10 hectareorchard lots and one 50 hectare lot. The five smaller lots would be sold to individual investors to be managed by GGC. The 50 hectare lot would be sold to Agricola and be owned by the shareholders.

It seems that Johnson never got around to subdividing the orchard, even though he somehow did get around to selling the orchard lots that didn’t exist. Maybe he was too busy trading for Andean water scams or stealing money for wildly profitable bitcoin investments. It could have been that his architects and engineers were exactly as he describes them—crooked and/or incompetent. That has yet to be determined.

What we do know is that subdividing the orchard is a rather straight forward process. Since the purpose of the land would be the same, the subdivision was granted as a matter of right. Once Johnson finally applied for the subdivision in September 2014, it cost approximately $5,000 and took a couple of weeks. Johnson should have had subdivision approval before selling share subscriptions and orchard lots.

Johnson’s sales team was able to sell only 30% of Agricola shares. Many investors who wanted to buy shares were advised against doing so by their attorneys and financial advisors who rightly cautioned against buying shares of nothing. As it was, he finally got around to subdividing the orchard as a public relations gesture after the investors disclosed his malfeasance in various internet articles, but he never transferred title of the orchard to Agricola. It’s still a shell company.

The brochure for the Agricola farm share program is a true marketing tour de force. (See for yourself here.) We hesitate to call it a prospectus, although Johnson called it that, since is it nothing  like any prospectus we’ve ever seen. No cautionary boiler plate, no warnings about how you could lose everything are included with the blue sky. We are assured that the farm is organic, even though in the next sentence we are told that it’s not, and that there’s a fantastic amount of water, even though most of the avocado trees are dead and the survivors are not producing due to water stress. We’re left with the impression that farming is really very easy in the can’t miss Mediterranean climate of central Chile. And hoo-wee! Look at all dem profits:

like any prospectus we’ve ever seen. No cautionary boiler plate, no warnings about how you could lose everything are included with the blue sky. We are assured that the farm is organic, even though in the next sentence we are told that it’s not, and that there’s a fantastic amount of water, even though most of the avocado trees are dead and the survivors are not producing due to water stress. We’re left with the impression that farming is really very easy in the can’t miss Mediterranean climate of central Chile. And hoo-wee! Look at all dem profits:

Year Net Profit

2014 $582,888

2015 $1,243,181

2016 $1,262,923

2017 $2,660,387

2018 $3,091,672

2019 $3,523,871

2020 $4,016,738

The reality is quite different. One of the first things the employees told the investors when they took over the farm is that it is not profitable. The lemon harvest for 2013 was about 3 tons per hectare versus 30 tons per hectare for a healthy orchard. There were sections of the orchard that hadn’t been pruned in five years by the previous owner. There are mineral deficiencies in the soil. The irrigation system is aging and in need of an upgrade. The projections above are simply impossible. It will take time and money for the orchard to recover, even with million dollar improvements. However, there was no money for improvements. The $2.779 million taken in as loans for the farm were used to buy the Lepe/Las Casas property, or stolen by the Del Real family.

Five Star Guest Accommodations

Never fear, lucky Agricola shareholders. Even if the farm can’t make money, steady passive income could still be yours. Johnson planned to rent rooms in the main residence, the hacienda he referred to as the club house, and in the guest cabaña he referred to as a hacienda. From the marketing materials:

“The rooms in the Inn at Galt’s Gulch and the freestanding Guest Hacienda are projected to rent for $150-200 USD per night, with occupancy levels at 50% in 2014, increasing to an average of 75% occupancy thereafter. These units are projected to be in very high demand. They will have road access, 220 volt power, hot and cold running water, Internet access, television, full maid service, room service and amenities typical for upscale hotels, while allowing those staying there to experience all of the beauty of living at GGC.”

Cabaña being renovated for the fall celebration. Johnson told the contractor to paint over any problems, but the contractor had too much integrity to do so. These cabañas are small, two room buildings, little more than a bedroom and sitting room, situated in the middle of the orchard and hardly on the level of upscale hotels, as advertised.

This guest stay operation was to net $180,000 in 2014 and with profits climbing to $297,674 (and no pennies) in 2015. You might ask what profit Johnson achieved in the first 10 months of 2014. Or, having read this far, you might not need to ask.

To round out this sure thing, passive income operation, GGC would launch its own brand of organic produce that would become renowned the world over. Johnson filled pages 13 to 28 of the brochure with tables of fruits and vegetables projecting the many millions in profits that would fuel investor dividends.

Johnson’s first foray into row crops was initiated just in time for the April 2014 celebration—a marketing event at the farm—when he had a field of about three acres planted. The Potemkin Village plot impressed some of the investors, as did the half-completed renovations for the Inn at Galt’s Gulch. Alas, the field was left to be eaten by the birds and no first harvest for Galt’s Gulch Organics was produced.

As expected, the Inn’s renovations weren’t completed, either.

No-Contracts-ville

In summary, the investors in GGC either hold unenforceable contracts because they were not properly legalized according to Chilean law, or they hold legal contracts that give them the rights to nothing.

One might say that the lesson of GGC is that investors should always hire local attorneys to be advised on how to enter into sound, legal contracts, and that’s certainly true. Yet some GGC investors did just that, and still have nothing to show for their trouble.

The most important lesson of GGC is that contracts are not self-enforcing, particularly not invalid ones. Because of this, the level of due diligence required to enter into an investment with an unknown developer in a foreign land is orders of magnitude greater than what we GGC investors did.

orchards and 7ish hectares of dead and dying avocado trees. This allowed Johnson to jump on the trendy Latin American agriculture investment bandwagon with his orchard and farm share program.

orchards and 7ish hectares of dead and dying avocado trees. This allowed Johnson to jump on the trendy Latin American agriculture investment bandwagon with his orchard and farm share program. renewable energy industries. Mr. Johnson has worked with numerous high-profile Hollywood celebrities, such as Jay Leno, Ed Begley Jr., Larry Hagman and others on television and internet projects to educate the public and brand product lines in the environmental industry. He has worked as a consultant in real estate, renewable energies, asset diversification, investing and relocation around the globe.”

renewable energy industries. Mr. Johnson has worked with numerous high-profile Hollywood celebrities, such as Jay Leno, Ed Begley Jr., Larry Hagman and others on television and internet projects to educate the public and brand product lines in the environmental industry. He has worked as a consultant in real estate, renewable energies, asset diversification, investing and relocation around the globe.” with Hollywood celebrities who were more than willing to lend their names without checking into the corporation first. (Sound familiar?) Chased out of California due to bankruptcy and tax problems, Johnson took up selling fraudulent passports, most notably in Paraguay, aka ‘consulting in relocation around the globe.'”

with Hollywood celebrities who were more than willing to lend their names without checking into the corporation first. (Sound familiar?) Chased out of California due to bankruptcy and tax problems, Johnson took up selling fraudulent passports, most notably in Paraguay, aka ‘consulting in relocation around the globe.'” business plan with Agricola looks eerily similar to Rowan’s. The Agricola “prospectus” is a stream-of-consciousness irrelevancy that in and of itself may constitute fraud.

business plan with Agricola looks eerily similar to Rowan’s. The Agricola “prospectus” is a stream-of-consciousness irrelevancy that in and of itself may constitute fraud. company that owns nothing. The revenue from the farm program was split between Ramirez to purchase the Lepe property, and Del Real who stole roughly $1 million. Virtually nothing went to upgrade the farm. Agricola stock was never delivered to the share buyers, and the only dividends paid were to the few people who bought shares on crypto-trade.

company that owns nothing. The revenue from the farm program was split between Ramirez to purchase the Lepe property, and Del Real who stole roughly $1 million. Virtually nothing went to upgrade the farm. Agricola stock was never delivered to the share buyers, and the only dividends paid were to the few people who bought shares on crypto-trade.