The following letter was written by Josh Kirley and sent to as many GGC investors has he could determine. It was the result of months of  investigation and thousands of dollars trying to uncover the truth about GGC and expose Johnson for the con man he is. We owe Josh a debt of gratitude because without this effort, we investors might still be in the dark.

investigation and thousands of dollars trying to uncover the truth about GGC and expose Johnson for the con man he is. We owe Josh a debt of gratitude because without this effort, we investors might still be in the dark.

Josh used the pseudonym Eddie Willers after a character in the novel Atlas Shrugged, the work that lent Galt’s Gulch Chile its name. We think he should have used Hank Reardon instead.

Johnson has never refuted anything in this letter. His only answer has been to attack Josh for using a pseudonym, as if that’s the crime of the century.

What follows is long but it is for the most part spot on, and therefore worth the read.

I am sorry to be the bearer of bad news, but you are receiving this email because of your investment in or association with Ken Johnson and Galt’s Gulch Chile (GGC). What follows is a brief timeline of this project – a short summary of a much larger story that is still being written. This will be the first of many emails detailing the scheme of which you are a victim.

email because of your investment in or association with Ken Johnson and Galt’s Gulch Chile (GGC). What follows is a brief timeline of this project – a short summary of a much larger story that is still being written. This will be the first of many emails detailing the scheme of which you are a victim.

In 2012, Ken Johnson and Jeff Berwick (The Dollar Vigilante) explored the idea of creating a community in Chile that would appeal to people worried about the financial and political stability of their home countries. Chile, they believed, would be a welcoming home for those of a libertarian/anarchist and free market bent, much as Argentina is home to Doug Casey’s Cafayete. Turns out that John Cobin (Host of Red Hot Chile) and his associate German Eyzaguirre also had plans to launch a community in Chile. When Berwick and Johnson met Cobin and Eyzaguirre in Chile in late 2012, they decided to join forces. Cobin and Eyzaguirre had tried to purchase land near Curacavi – a plot of land referred to as El Tranque (aka Freedom Orchard) – but could not raise the funds to fulfill the contract. Cobin and Eyzaguirre helped Johnson find a tract of land nearby – Caren, known locally as “El Peñon” for a large rock formation near the crest. In exchange for finding the property and helping to facilitate the deal, Cobin and Eyzaguirre would receive $250,000 and 30% of the shares of the holding company. Berwick and Johnson would evenly split the remaining 70%.

$1.75 million was raised from four Founders, known as the “First Round.” Within a month, the sale had been made for $1.18 million – the majority of the money that the four founders (funders) had put up. None of the founders was Johnson, Berwick, Cobin and Eyzaguirre, or any of his associates. They were just regular people who wanted to move to the proposed community. As quickly as the sale had been made, it was discovered that the land would be unsuitable for the promised development. They told the first rounders it would be subdivided into 3,000 parcels. Turns out it could only be divided into 12 parcels. And even those 12 had building restrictions due to the elevation and being zoned for agricultural use. To top it off, though there were water rights (surface only), there was very little water. Johnson failed to register the few wells that existed, within the required timeframe, making matters worse. The entire deal was a spectacular failure. Johnson would later place fault with Cobin and Eyzaguirre for misrepresenting the possibilities of the land. That should have been the end of Ken Johnson’s tenure as developer or manager of a community of expatriates in Chile. Instead, it was just the beginning.

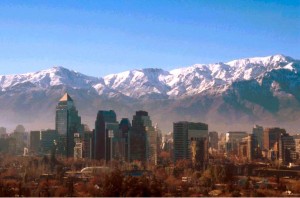

This photo appears in early marketing lit for GGC, so the investors of course thought it was of El Peñon. It is of a neighboring property.

To rewind a bit, before the sale of Peñon was registered to one of many legal entities tied to GGC, Berwick and Johnson managed to nullify their deal with Cobin and Eyzaguirre, and register title to the albatross Peñon land to a Chilean entity – Inmobiliaria [Galt’s Gulch] SA – that only they had 50/50 control of. Johnson’s swift move to oust Cobin would foreshadow Berwick’s own treatment by Johnson.

In a display of pure brass, Johnson doubled down and found another property adjacent to El Tranque and Peñon: a land known as Lepe. Without a penny to his name or a single investor, he negotiated a cash deal (to be paid in installments), agreeing to pay a staggering $6,850,000.00 USD for land and water rights. Now, why would the seller, Guillermo Ramirez, make a deal with a total stranger, from a foreign country, who had no money and no reputation? In short, he did so, because Johnson was offering him nearly 4 million dollars more than the price he had already agreed to sell the land for (to Cobin and Eyzaguirre). Locals were astounded by the price tag. Some allege there was a kickback scheme between Ramirez and Johnson; this theory is buoyed by the fact that in addition to the inflated purchase price, Ken Johnson was to issue a 5% stake in Galt’s Gulch Chile to Sr. Ramirez, when payments were completed. Still others believe this is just another case of a foolish Gringo being taken by a wise local who grossly overstated the value of the land, the profitability of the farm, and the amount of water. (Johnson would later exaggerate these already inflated figures to potential clients.) The actual amount of water is not known because Johnson, for a second time, going against the advice of his paid legal counsel, performed no due diligence. Not a single water test was performed.

Upon hearing that his employee and partner had unilaterally  entered into another hasty land deal, Berwick panicked. Johnson had no credibility or reputation. This entire venture was on the shoulders of Berwick. The initial debacle could have been enough to destroy his reputation. He had been heavily promoting the idea of this community, shared 50% of the holding company, and had even given Johnson 50% of his organization, The Dollar Vigilante. Ken was also doing other business development for The Dollar Vigilante, most notably a questionable Paraguayan passport program. Berwick apparently felt he was in too deep to turn back. And even though he had doubts, he continued to play the hand he was dealt, and went about promoting the community and stood behind Ken Johnson’s efforts to secure the additional land purchase.

entered into another hasty land deal, Berwick panicked. Johnson had no credibility or reputation. This entire venture was on the shoulders of Berwick. The initial debacle could have been enough to destroy his reputation. He had been heavily promoting the idea of this community, shared 50% of the holding company, and had even given Johnson 50% of his organization, The Dollar Vigilante. Ken was also doing other business development for The Dollar Vigilante, most notably a questionable Paraguayan passport program. Berwick apparently felt he was in too deep to turn back. And even though he had doubts, he continued to play the hand he was dealt, and went about promoting the community and stood behind Ken Johnson’s efforts to secure the additional land purchase.

On both El Peñon and Lepe, Ken Johnson paid a premium and did no due diligence. He did not sufficiently verify the zoning status or perform water tests, either time. And he did not commit a cent of his own money to either purchase. The same can be said for Cobin, Ezyzaguirre, and Berwick. Since Johnson had no skin in the game and he was not a public personality like Berwick, Casey, Black, or Cobin, he never had anything to lose. And, he would behave accordingly. At one point, the lawyer for the New Zealand trust – Evgeny Orlov – described Johnson’s behavior as follows: “Ken has accused almost everyone I know of extremely serious things when he appears to be playing with his investors money like a child in a sandpit.” (2/26/14).

In defending his rushed purchase, Johnson misrepresented to Berwick and other investors that there were several competing bids on the land purchases. He made it appear that time was of the essence in both deals; this high pressure sales tactic would later be used on potential investors. With Ken Johnson it was always: “We must act right away, the time is now.”

His malfeasance would not be limited to acquisitions. His behavior would, within a year, alienate almost everyone who was associated with the project: partners, employees, professionals, vendors, the local community, and investors.

Ken Johnson partners with someone, uses their money, time,  reputation, and resources, and when they are no longer of use to him, he discards and vilifies them. And even though Ken Johnson has been the sole director of Galt’s Gulch Chile since inception, he has taken no responsibility for its continued failure and downward spiral. It is always everyone else’s fault

reputation, and resources, and when they are no longer of use to him, he discards and vilifies them. And even though Ken Johnson has been the sole director of Galt’s Gulch Chile since inception, he has taken no responsibility for its continued failure and downward spiral. It is always everyone else’s fault

In April of 2014, Johnson showed his true self and his true motives. Even though he was not paying his investors, his employers, his contractors, or the landowner, he negotiated to purchase 51% of a company called Rio Colorado from a local “businessman” who had worked for the Chilean IRS: Mario Del Real. Johnson agreed to pay Del Real the mind numbing sum of $8.1 million USD. This was to be a private, personal purchase for the sole benefit of Ken Johnson, having no benefit for, or relation to, GGC.

Let that sink in. Someone with no backers, a negative net worth, and owing millions of dollars, agreed to make a private purchase of this magnitude. Why did he think he would get away with it? Because he already had. Twice. It began with El Penon, then pulled it off with Lepe; now he figured he could do it again with Rio Colorado. When the money came due, and he was light $8.1 million out of $8.1 million, he decided to trade the equity, held by GGC.

This would be tricky for a couple of reasons. First, he told his investors and clients that all shares were held in escrow. Second, it would need approval. Knowing this would not be possible without support of the board of directors, he simply named a new board of directors: the very family he was trading GGC’s assets to: the Del Real family. What was interesting about this maneuver is that it was done twice. Both times through official notaries. Each times with drastically different signatures, proving that at least one, if not both, documents are forgeries. The new, hand picked Board, had no assets, investments, or interest in GGC and were granted control of the entire project. Mario, after receiving over a quarter million USD, became majority shareholder; his daughter Pamela became managing partner, treasurer, and accountant. And, his children were each given 10% ownership. Since Ken no longer had the ability to receive international wires because he refused to identify the source of funds, Pamela Del Real’s personal bank account became the corporate bank account for GGC. Including bitcoin wallets, this would be one of more than 15 accounts used by Ken Johnson to receive client funds.

At this point, I bet you are wondering, ‘How did this happen?’. How was someone with no experience, no reputation, and no money, able to pull off a multi-million dollar Ponzi scheme? Well, first it took big balls. And each time he was allowed to get away with something, he got even more brazen.

Second, he had a lot of accomplices. Some were willing, but most were unwitting.

These pix and video are from Johnson’s environmentalist affinity fraud days. He was “president” of Enviro-Energies selling wind turbines for “clean” energy. He claims he was the victim of that scam. As president. Hmmm. The company was busted up by the feds. Johnson wasn’t prosecuted, but the records show he wasn’t president–just an exaggeration, we guess.

Btw, Leno recently told one of the investors he doesn’t know Johnson. We wish we didn’t, either.

By aligning himself with established names, these accomplices gave Johnson an air of respectability. People saw that Johnson was aligned with people who they knew and trusted, so they transferred that trust onto him. Initially, it was his association with Jeff Berwick that raised money for the first land purchase. Later, it was his direct association with media personalities like Josh Tolley and Ben Swann that gave him credibility within the Freedom movement. Others were swept into his web when Johnson mentioned that he had worked with Jay Leno, Ed Begley, Jr, and Mario van Peebles. The fact that he was represented by the Carey Group, the largest and most prestigious law firm in South America, got many investors to let their guard down. This was a most curious pairing because Johnson actually paid these attorneys, with investor funds, to represent himself against those same investors. As recently as 8/18/14, Johnson forbade the Carey Group (and all of his former legal advisers) from sharing any information with GGC clients. And, ignoring their own code of legal ethics, they complied.

In fact, to date, Johnson has never shared a budget, a financial ledger, a business plan, a mission statement, or any formal documentation with a single client. He refuses to reveal how much money he has taken in, how much money he has spent, how it was spent, how much money he has, and how much money he owes. He cannot or will not even say who owns the land and who is running the project. These are all very basic, straightforward questions that every client and investor deserves to have answered.

I do not expect you to accept the story from an anonymous email. I implore you to do your own investigation. Do not make the same mistake twice, by taking another stranger at his or her word. Blind trust created this situation. Be accountable to yourselves and to each other. Do some research. Reach out and contact your fellow investors/victims. Email or call former employees, former attorneys,  architects, builders, salespeople. You will find a single bond that joins them all. Every single one of them was lied to by Ken Johnson. Every single one of them was mistreated by Ken Johnson. And, every single one of them is owed money by Ken Johnson.

architects, builders, salespeople. You will find a single bond that joins them all. Every single one of them was lied to by Ken Johnson. Every single one of them was mistreated by Ken Johnson. And, every single one of them is owed money by Ken Johnson.

Ask what he did with the millions of dollars that he has taken in. Ask how many bank accounts he has. How many bitcoin wallets has he used? Why did he pay over a million dollars for land that could not be divided or lived on? Why did he agree to pay $6,850,000.00 (over 8 million, after late fees) for land and water rights , when the owner had already agreed to sell them to someone else for only $3 mill USD? Why did he refuse to identify the source of his funding to his own attorneys and his own bankers? On more than 10 occasions. Why has he physically and verbally abused employees and issued “cease and desist” orders or threatened suit against more than 2 dozen current investors and former workers?

Who owns GGC? Who is the managing director? Who holds the bank account or accounts that new investor money flows into? Who is the sales director? Who is the general contractor? Who is the accountant? Who is the attorney? Where are the financial records? Why has a master development plan or business plan not been created or approved? Why have farm and orchard owners not received dividends? Or any information, for that matter? Press Ken on why he has not fulfilled his repeated promise to turn the project over to the clients, whose money he squandered, in the percentage that they invested

Here are a few unsolicited suggestions, from someone who left a great life and a job, to move to Chile, in the hopes of building this ambitious project. First, you have to accept that you have been conned. Most of you are probably not shocked by this news. Some of you understand the nature of investments, and know that there are not sure things. For others, this may be more difficult. But, you must accept that your money is gone. It was taken by a crook. A con artist without a conscience. He is a tyrant whose only power has come from the money that he has received from trusting investors. Needless to say, it is incumbent upon all of us to make sure that he receives no more. To do so would be abetting a Ponzi scheme.

Second, you need to extricate that crook from the equation. With the amount of damage that Johnson has done to this project, the road to success is much longer and more difficult than it otherwise would have been. But, there is no doubt, in anyone’s mind, that as long as his claws are in GGC, there is absolutely zero chance of this community ever becoming a reality. He and Mario del Real have proven they will sell off every marketable asset GGC owns, while neither of them have ever put in a penny. Meanwhile, you all, the real owners, are left on the outside looking in. Federal authorities, in both Chile and the US, have been alerted to his actions, and are acting on them. But, a lot of damage can be done between now and the time that justice is served.

Once he is removed, there will be a great deal of messes to clean up. Johnson has made enemies around the Curacaví region, in Santiago, the United States, and on four continents. He did this in the name of GGC. Whether it is through active marketing or total rebranding, the damaged parties need to know that there has been a clean break between Ken Johnson and the people he purported to represent. Finally, he needs to be replaced.

His replacement should be everything he is not. This person should have experience. They should have references. They need to be bilingual. They need to be local, or have a knowledge of the local culture. Most importantly, they need to have their own skin in the game. Johnson behaved so recklessly because he had nothing to lose. He spent so frivolously because it was not his money. You need to align with an equity partner, whose success is tied to your own.

Finally, there needs to be transparency and a system of checks and balances. Johnson kept this sham alive for so long because he was able to compartmentalize and separate so many parties; there was no transparency. He refused to introduce investors to each other. If he found out that clients were communicating, he denounced it as meddling. If employees talked to one another (ostensibly, about the fact that they had not been paid in months), he reprimanded them for “gossiping.” There was no oversight, no legitimate Board of Directors, no accountability. Secrecy begat tyranny.

Finally, you all need to become involved. This should not be a passive investment. Get your asses down to Chile. Live on the land. Oversee the construction. And, take it upon yourselves to build this community into your own vision. All is not lost. But, it will be, if you do nothing.

are told that he had the architects draw plot lines on satellite maps of Lepe as if there were a master plan in place. He even took individual investors to their “lots”–what lots, we don’t know, since there was no subdivision approval–and told them he was reserving that land for them.

are told that he had the architects draw plot lines on satellite maps of Lepe as if there were a master plan in place. He even took individual investors to their “lots”–what lots, we don’t know, since there was no subdivision approval–and told them he was reserving that land for them.